|

Preparing to Sell Your Home: A Complete Checklist

Getting your home ready to sell can feel like a circus act. Without the right organization, juggling the countless moving parts involved in this stage of the selling process can take its toll. This is the perfect opportunity to create a checklist to keep yourself on track and within your budget. The following information will illuminate the key responsibilities you face as a homeowner as you prepare to hit the market.

We’ve included a comprehensive checklist below of the common tasks required to get your home ready to sell. It is also available as an interactive web page and downloadable pdf here: Get Ready to Sell Checklist

Preparing to Sell Your Home: Working with an Agent

Before you start working on the house itself, it’s best to get the ball rolling on the strategic aspects of selling a home. Working with a real estate agent is the best way to get your home sold for the best price in a timely manner.

A listing agent will represent you throughout the selling process to determine the value of your home, coordinate open houses, market the property, and negotiate with buyers to reach a deal. In the early stages of your discussions with your agent, they will conduct a Comparative Market Analysis (CMA) to see what price your home could fetch on the market, accounting for various factors that influence home prices such as seasonality and local market conditions. Based on the findings of your agent’s CMA, you can discuss whether remodeling fits into your go-to-market strategy, and your agent can provide intel on which remodeling projects could deliver significant ROI based on buying trends, your location, and what comparable listings in your market are offering.

Home value estimation tools can help you get an idea of what your home is worth to facilitate your conversations with your agent.

Image Source: Getty Images – Image Credit: FG Trade

Preparing to Sell Your Home: A Complete Checklist

Once you’ve found an agent, you’re ready to get your home in tip-top selling shape. The following checklist is available as a free downloadable PDF here:

Get Ready to Sell Checklist – PDF

Exterior

This list of value-adding curb appeal projects will help to form buyers’ first impressions of your home and make your ever-important exterior listing photos stand out amongst the competition.

- Remove peeling and chipped paint; replace with a fresh coat

- Fix loose trim and fencing

- Clear gutters and downspouts

- Make sure there is good exterior lighting and all walkway lights and front-door lanterns work

- Clean and repair the roof as needed

- Clear garage of clutter and tidy shelves

- Inspect chimney for cracks and damage

Yard

- Mow and trim grass; re-seed and fertilize where necessary

- Prune all overgrown trees and shrubs

- Weed flowers beds

- Remove or replace dead or diseased plants, shrubs, and trees

- Clean grease and oil stains from driveway

Decks/Patios

- Paint or stain worn areas on wood decks

- Remove grass growing in concrete cracks; sweep off debris from shrubs and trees

- Clean all deck rails and make sure they’re secure; replace missing slats or posts

- Clean outdoor furniture

Front Door

- Polish or stain worn areas on wood decks

- Add a fresh coat of paint to get rid of nicks

- Clean the glass on the storm door; make certain the screen is secure

- Make sure the doorbell operates properly and there are no squeaks when the door opens and closes

Windows

- Clean all windows inside and out

- If needed, add a fresh coat of paint to the window trims and sills

- Make sure all windows open and close easily

- Replace cracked windowpanes and those with broken seals

- Make sure window screens are clean and secure; replace any screens with holes or tears

Front Entry

- Clean entryway floors and area rugs

- Downsize clutter in the entry and entry closet to give the appearance of spaciousness

- Double-check entry lighting to make sure it works

Interior

Not only will these interior projects get your house sparkling clean, but they’re also preparatory steps for staging your home and hosting open houses.

General Interior Cleaning

- Clean all floors, carpets, walls, and trim

- Replace burned-out light bulbs

- Empty trash

- Remove family photos, valuables, and prescription drugs

- Tidy up clutter

Kitchen

- Fix dripping faucets

- Organize pantry and cupboards so they appear clean, neat, and spacious

- Make sure the refrigerator and freezer are defrosted and free of odors

- Clean the oven and cook top thoroughly

- Set the table

Living/Family/Dining Rooms

- Give rooms a fresh coat of paint as needed

- Repair cracks and holes in ceiling and walls

- Make sure all wallpaper is secure

- Repaint any woodwork that is worn or chipped

- Clean or replace draperies and blinds; open them to maximize light

- Make sure draperies and blinds open and close

- Steam-clean carpets

- Clean rugs and wood flooring, and remove any stains or odors

- Position the furniture to showcase the size and space of the room

- Remove and replace any attached items, such as chandeliers and draperies, that you wish to move with you

- Put away toys and hobby supplies; remove extra magazines and books from tables

Bathrooms

- Make sure sinks, tubs, showers, and countertops are clean and free of stains

- Repair any leaky faucets

- Remove grout and soap stains from tile

- Replace any missing or cracked tiles or grout

- Make sure all joints are caulked

- Make sure all fixtures, including heat lamps and exhaust fans are operating

- Install a new shower curtain and buy matching towels

- Store all supplies, such as toilet paper, shampoo bottles and cleansers, out of sight

Bedrooms

- Repair cracks in ceiling and walls

- Apply a fresh coat of paint if necessary

- Make sure all wallpaper is secure

- Clean draperies and blinds; open them to maximize light

- Put away toys, clothes, and clutter

- Neatly make up the beds

Basement

- Check for water penetration or dampness; call for professional repairs if necessary

- Get rid of musty odors

- Clean furnace, hot water heater, and drains

- Make sure light fixtures work

- Arrange storage area in a neat and organized manner

- Make sure stairway handrail is secure

Tidy Extras

- Use air fresheners or bake treats to make the house smell good

- Plant flowers to brighten the walkway and enrich the entry

- Remove any indoor houseplants that are brown or losing their leaves

- Remove all “fixer” cars, campers, and boats from the property

- Discard the clutter of magazines on the coffee and end tables

- Tidy and declutter all closets

- Hide or get rid of worn-out throw pillows

- Store pet supplies

- At night, turn on the porch light and outdoor lighting

- Put away toys and hobby supplies; remove extra magazines and books from tables

How to Plant an Herb Garden

Homeowners are always seeking ways to breathe new life into the spaces in their homes. Using nature to achieve this transformation is beneficial in several ways. Planting an herb garden not only helps to make your kitchen feel fresh and sustainable, but it can make your food taste better, too. Here are some tips for getting your herb garden started.

How to Plant an Herb Garden

Like other indoor plants, the key to properly supporting your herb garden is to cultivate fertile growing conditions. Herbs love sun, so you’ll want to position your plants in an area where they have access to sunlight. If sunlight is hard to come by in your local climate, consider investing in a grow light. Even if space is limited, the following locations can be a fitting home for your herb garden:

Container Garden

Container gardens give you the flexibility to move your herbs around the house. This can be especially helpful if you get inconsistent or spotty sunlight.

There are various options when choosing materials for your containers. Terra cotta, plastic, and ceramic planters all have their respective advantages, but what’s most important is that you pair the herbs with a container whose size is conducive to its growth and has proper drainage holes.

Hanging Garden

A hanging garden is a stylish way to incorporate nature into your home. To properly set up your hanging garden, you’ll need adequate wall space. Again, prioritize access to sunlight and easy accessibility. Vertical bookshelves can make for a simple, multifunctional hanging garden, while other DIY options can help to spruce up your kitchen. Whichever route you choose, consider using lightweight materials. A mobile hanging garden can come in handy when doing chores and rearranging the house.

Window Box Garden

Box gardens are a fixture of landscaping and gardening design and can help to improve your home’s curb appeal. Once they’re filled with soil, plants, and water, window boxes can be much heavier than you’d expect, so sturdy woods that don’t rot easily—cedar, mahogany, redwood, etc.—are popular material choices. As always, proper drainage is important when crafting your window box garden. If you’re building your window box yourself, drill the proper drainage holes before assembly. Add a layer of landscaping fabric along the bottom to prevent soil from leaking.

Image Source: Getty Images – Image Credit: deniskomarov

Easy Herbs to Grow in Your Garden

After you’ve decided where you’ll set up your garden, there’s the question of which herbs to grow. The following herbs are perfectly suited for a beginner gardener’s touch and happen to be culinary staples.

- Basil: Fresh basil is a game changer. Sow basil seeds around twelve inches apart to allow them to reach their full potential. This herb will take your homemade pizzas to the next level, kick your pesto recipe up a notch, and provide the perfect garnish for countless other dishes.

- Thyme: Rich soil fused with organic matter will create ideal growing conditions for thyme. This herb loves the sun, so making sure it gets plenty of sunlight will maximize its flavor. Thyme pairs perfectly with roasted and slow-cooked dishes, adding a perfect layer of warmth and depth.

- Cilantro: Make taco night unforgettable with fresh cilantro. With enough heat, cilantro plants will grow quickly and are known to self-sow for multiple rounds. To clear up confusion, cilantro and coriander come from the same plant. “Cilantro” refers to the leaves, while “coriander” is the name for the plant’s seeds, which are often ground up when used in cooking.

- Mint: Potting mint is key to keeping it well maintained. Without a proper container, it will run wild. There are many varieties of mint, ranging from classics like spearmint and peppermint to exotic strands such as chocolate and cinnamon mint.

- Parsley: Parsley takes its sweet time to germinate, so consider buying plants rather than seeds to speed up the growing process. Countless recipes lean on the fresh taste of parsley, so you can’t go wrong dedicating a decent amount of real estate in your herb garden to it.

- Oregano: Oregano thrives in sunny conditions. To maximize growth, plant its seeds some time in spring when the soil is warm. A staple of Italian cooking, having fresh oregano in your herb garden will give your pizza and pasta recipes an extra kick.

- Chives: Known for their grass-like look, chives are closely related to onions but have their own distinct taste. Sow their seeds in spring and water regularly to keep their soil moist. Chives are a flavorful alternate for onions or scallions, while their bright green color makes them a perfect garnish for soups, salads, and sauces.

The Growing Housing Affordability Problem

This video is the latest in our Monday with Matthew series with Windermere Chief Economist Matthew Gardner. Each month, he analyzes the most up-to-date U.S. housing data to keep you well-informed about what’s going on in the real estate market.

Hello there, I’m Windermere’s Chief Economist Matthew Gardner and welcome to this month’s episode of Monday with Matthew.

If you’ve listened to me at all over the past several years, you’ll know that I am pretty passionate about one subject: housing affordability. And, given the significant price growth that we’ve seen over the past decade, as well as the recent spike in mortgage rates, I wanted to talk a little bit about what might be done to address this very serious issue.

The Growing Housing Affordability Problem

Now, when we think about housing affordability and how it might be solved, a lot of people get tied up in the minutiae when, quite frankly, it really isn’t that hard a problem to solve. You see, there’s one very simple way to address this: to build more housing units. But, as easy as that may sound, there are a lot of obstacles that are holding new supply back. But before I get to that, I want to share some data with you that might help to demonstrate how serious an issue we all face.

Every quarter, the National Association of Homebuilders puts out its affordability numbers for metro areas across the country. An analysis of sales and incomes allows them to show the number of homes—both new and existing—sold in a quarter that were affordable to households making median income.

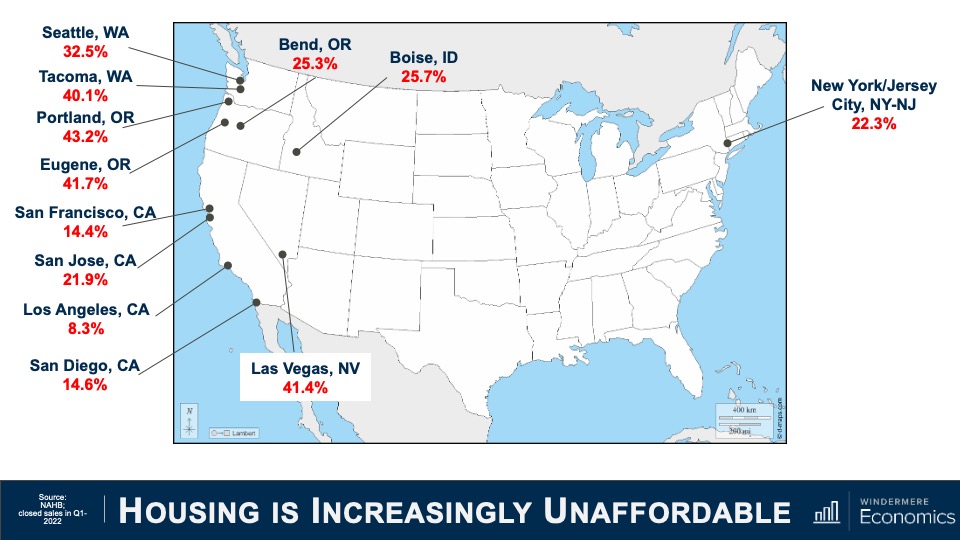

Housing is Increasingly Unaffordable

Here you will see numbers from just a few of the 240 metropolitan areas across the country and the share of sales in the first quarter of this year that were “technically” affordable. I think you’ll agree that it’s eye opening.

Although I am only showing you a few of the U.S. markets I will tell you that the ten least affordable US housing markets were all in California. The Golden State is also home to 21 of the top 25 least affordable markets in the country. But what you might also find interesting is that our primary cities aren’t the only ones that are suffering from affordability issues, with markets like Bend, Oregon; Boise, Idaho; and even Las Vegas, Nevada becoming increasingly unaffordable for a lot of households.

And it’s worth mentioning that that 48 of the 69 markets where less than half of the homes sold were affordable were in states that have at some point in the past implemented comprehensive planning and growth management legislation. And when governments mandate where homes can and cannot be built, one thing happens: it pushes land prices higher which makes new homes more expensive and limits the amount of new supply that builders are able to provide. So, what can be done?

Well, I will start out by saying that states who have implemented growth management plans, which they generally did to slow or stop suburban sprawl, remain disinclined to move these boundaries, and that means it becomes paramount to not look further out but to concentrate within the urban growth boundaries and decide whether it’s time to think about removing single-family zoning altogether.

This is a fascinating thought, but I must add that I am not suggesting that we do away with single-family homes. Absolutely not! What I am thinking about is the ability for a market to decide what makes the most sense. In order to do so, single-family zones need to allow for the development of denser housing, but also allow the market to decide what’s best. Areas that have implemented such change has given rise to a movement in order to address what is being referred to as “missing middle housing.” For those of you who are unfamiliar with this term let me try and explain.

Missing Middle Housing

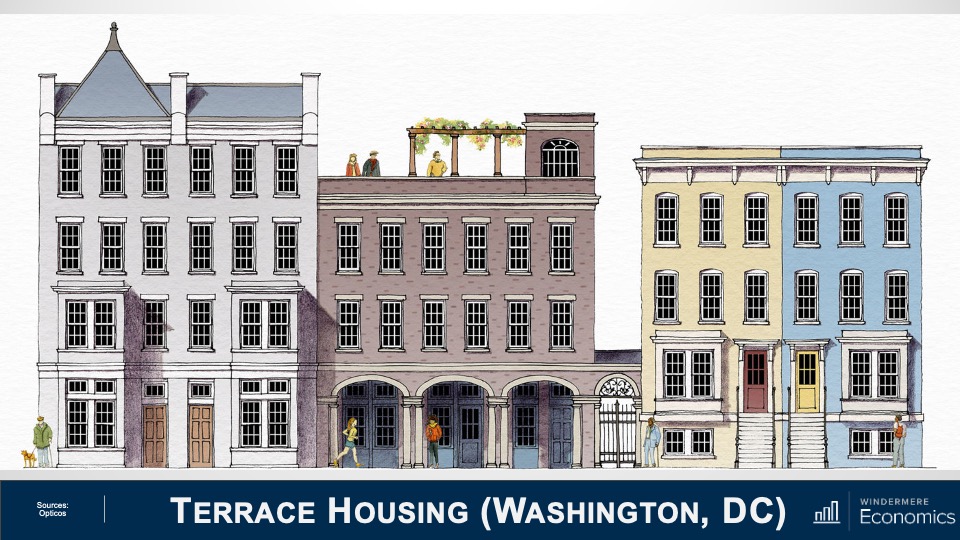

This is a great image courtesy of Opticos, a team of urban designers, architects, and strategists who are passionate about adding sorely needed housing options.

They came up with the term “missing middle” as it describes housing types that were actually very common prior to World War II where duplexes, row-homes, and courtyard apartments were in high demand. Unfortunately, however, they are now far less common and, therefore, “missing.”

And the key function of this type of housing is to meet the rising demand for walkable neighborhoods, respond to changing demographics, and provide housing at different price points. You see, rather than focusing on the number of units in a structure—think high rise apartments or condominiums—this type of housing emphasizes scale and heights that are appropriate for and sympathetic to single-family or transitional neighborhoods.

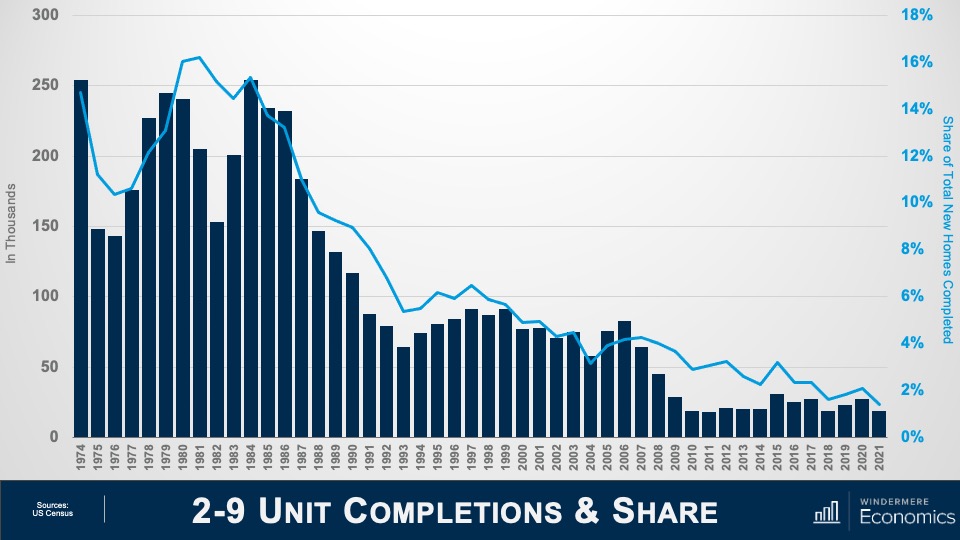

The Decline of Missing Middle Housing Construction

And to show you how supply of these types of units has changed, this chart shows the number of duplexes to eight-unit buildings built over the past almost half-century and you can clearly see that up until the late 1980s they were being built in decent numbers, but the 1990s saw a significant shift toward traditional single-family home ownership and builders followed the demand and this type of product started to become scarcer.

Almost 16% of total new homes built in America in the early 1980s were of this style, but that number has now shrunk to just 1.4%—or a paltry 19,000 units.

But I see demand for these housing types growing as we move forward and that buyers or renters, young and old, will be attracted as it will meet their requirements not only in regards to the type of home they would want to live in but, more importantly, it can be built cheaper than traditional single-family housing and therefore it will be more affordable.

But although this sounds like it’s a remarkably simple solution that can solve all our woes, in reality it’s not that easy for two very specific reasons. The first is that many markets are already essentially built out, meaning that in order to develop this type of product, a builder would have to purchase a number of existing homes and raze them in order to rebuild. But given current home values, it’s very hard for a builder to be able to make such a proposal financially.

And the second issue is that current residents within these “transition” areas—which have been developed as traditional single-family neighborhood—simply don’t want to see change. But is this type of product bad? Here are some examples.

This shows row-homes in Brooklyn on the left and traditional “triple-deckers” in Massachusetts on the right:

This is a bungalow court project in California:

Here are some Live/Work Units in Colorado:

These are some amazing mews homes in Utah:

And finally, a new terrace housing project that will be built in Washington DC:

Don’t get me wrong, I’m sure that some of you who simply aren’t inspired by this type of architecture, and that is understandable. But can we simply stick with the status-quo? I don’t think so. And some state legislators have already implemented significant zoning amendments in order to try and encourage this type of development.

Back in 2018, Minneapolis was the first city to allow this type of development inside single-family zoned areas. This was followed by Oregon State in 2019. Senate Bill 9 was signed by Governor Newsom of California last year which made it legal for property owners to subdivide lots into two parcels and turn single-family homes into duplexes, effectively legalizing fourplexes on land previously reserved for single-family homes. So, we are starting to see some change.

This is a good start but as I mentioned earlier in areas that are already built out, even this type of forward-thinking legislation will not be the panacea that some want. But I’m not giving up hope.

Addressing the “missing middle housing” would allow for homes of all shapes and sizes, for people of all incomes including workers who are essential to our economy and community. Here I am talking about our teachers, firefighters, administrative assistants, childcare providers, and nurses—just to name a few!

There are currently 45 million Americans aged between 25 and 34 and most aspire to homeownership. However, the massive price growth which, by the way, many of us have benefitted from over the past several years, has simply put a “starter home” out of their reach.

I will leave you with one last statistic. Over 28% of American households today are made up of a single people living alone, and it is anticipated that up to 85% of all U.S. households will not include children by the year 2025. Finally, by 2030, one in five Americans will be over the age of 65.

Are we going to meet the needs of the country’s changing demographic going forward? I certainly hope so, but it will take a lot of work for us to get there. As always, if you have any questions or comments about this particular topic, please do reach out to me but, in the meantime, stay safe out there and I look forward to visiting with you all again next month.

Advancing DEI: Windermere’s Continued Commitment to Change

Written by: Samantha Enos – Vice President of Diversity, Equity, and Inclusion, Windermere Real Estate

Since our company committed to affecting change with regards to diversity, equity, and inclusion (DEI) nearly two years ago, we’ve established several initiatives that have helped us move the needle toward making Windermere a more diverse organization and homeownership more equitable. Guided by our four DEI pillars—community, home ownership, leadership, and culture—we remain focused on finding paths to address discrimination, racism, and inequity within the real estate industry.

Some of our DEI efforts over the past two years:

- Hired a VP of DEI who is charged with advancing Windermere’s DEI efforts, as well as supporting Windermere offices with their DEI strategies, planning, and programs

- Developed a committee of Windermere agents, staff, and owners to discuss Windermere’s efforts and to provide input on the direction of our DEI strategies

- Conducted ongoing DEI training for the Windermere leadership team, as well as for franchise owners and managers

- Engaged with state and local REALTOR® associations to audit our developing DEI training and educational opportunities offered to agents through our Professional Development department

- Produced instructional documents to educate homeowners on the history of racially restrictive language in property deeds and how to strike/remove such language from their chain of title

- Launched a “Race + Real Estate” playlist on the Windermere Spotify channel that offers a selection of podcasts that explore how members of marginalized communities have historically been denied access to homeownership

Sam Smith “Hi Neighbor” Homeownership Fund

Launched in early 2022 through our partnership with non-profit lender HomeSight, the Sam Smith “Hi Neighbor” Homeownership Fund is designed to help low-to-moderate-income home buyers who have been historically underserved by traditional lenders. Through donations from the Windermere Foundation, U.S. Bank, and JP Morgan Chase, the Sam Smith fund is helping to reduce barriers to homeownership by funding loan products for Black/African American first-time home buyers in Washington State.

We have formed a Board of Directors made up of six agents to help manage the program and drive fundraising. As of May 2022, the Sam Smith fund has raised over $127,000 for first-time home buyers, including a personal donation of $50,000 from the Jacobi family to help seed the fund, with over $58,000 raised this year alone. We are actively seeking partnerships with down payment assistance programs in other states to expand our efforts.

Aspire Internship

Formed in partnership with the University of Washington College of Built Environments in July 2021, the inaugural Aspire Internship program produced eight interns, all of whom completed the program and received a $5,000 scholarship. We’ve already seen real-world impact stemming from Aspire, with one of the group project proposals contributing to the creation of an agent scholarship program (see WIN below), and in the hiring of an Aspire alumnus at a Windermere office in Seattle. The program is expanding in summer 2022, with nearly double the number of students participating.

WIN Scholarship Program

The WIN Scholarship Program was created after recognizing the need to build and support a diverse community of new agents. The program provides up to $2,500 for qualified new hires to be used for training, educational purposes, and relieving the financial burden of the startup costs involved with becoming a real estate agent. The program has made an impact outside of Windermere, as well. Using the WIN Scholarship as a model, Washington REALTORS® has established a pilot program in which they will sponsor one year of REALTOR® member dues, six months’ worth of MLS fees, and $400 worth of training for qualified BIPOC (Black, Indigenous, People of Color) agents.

DEI Resources

For more information on our commitment to diversity, equity, and inclusion, updates on our company initiatives, and further resources on the history of housing discrimination and its impact on our communities, visit windermere.com/dei.

Moving Patterns for U.S. Homeowners and Renters in 2021

This video is the latest in our Monday with Matthew series with Windermere Chief Economist Matthew Gardner. Each month, he analyzes the most up-to-date U.S. housing data to keep you well-informed about what’s going on in the real estate market.

Hello there. I’m Windermere Real Estate’s Chief Economist Matthew Gardner and welcome to the latest episode of Monday with Matthew. Over the past few months, analysts like myself have been starting to get our hands on early numbers from the Census Bureau and, although we won’t get the bulk of the data for another several months, I thought it would be interesting to take a quick look at some of the information that the government has put out specifically as it relates to patterns.

This is a relevant topic given the pandemic, with many people wondering if we saw a mass shift in where we choose to live because of COVID-19. This belief that we packed up and moved because of the pandemic is, at face value, quite credible, especially given that home sales in 2021 were at levels we haven’t seen since 2006. But the reality, at least from the data we have received so far, actually tells a different story.

Moving Patterns for U.S. Homeowners and Renters in 2021

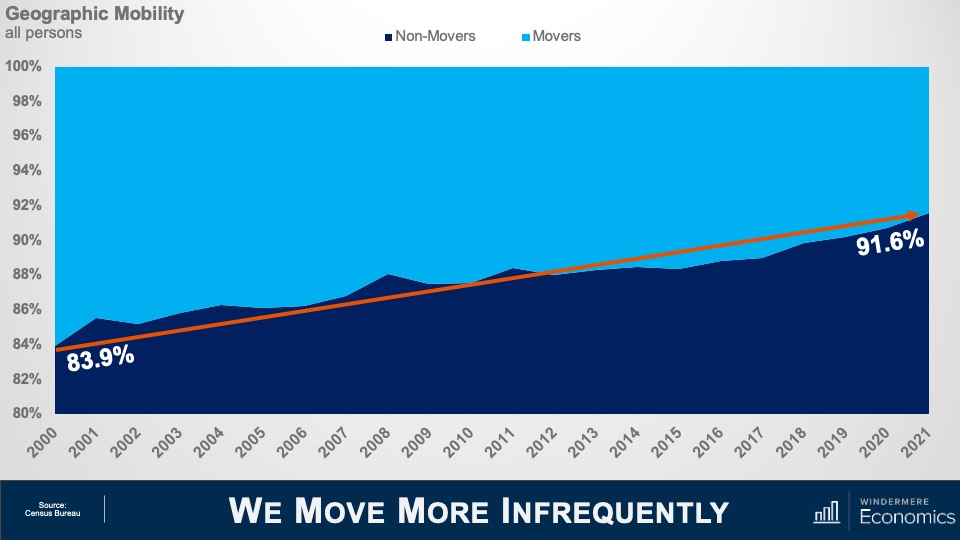

We Move More Infrequently

This first chart looks at people and not households and it shows that, contrary to popular belief, we’re actually moving less frequently now then we have done in decades, with the share of people not moving in a single year rising from just about 84% to over 91½%. Of course, we are having fewer children now than we did, but not to the degree that would change the trend.

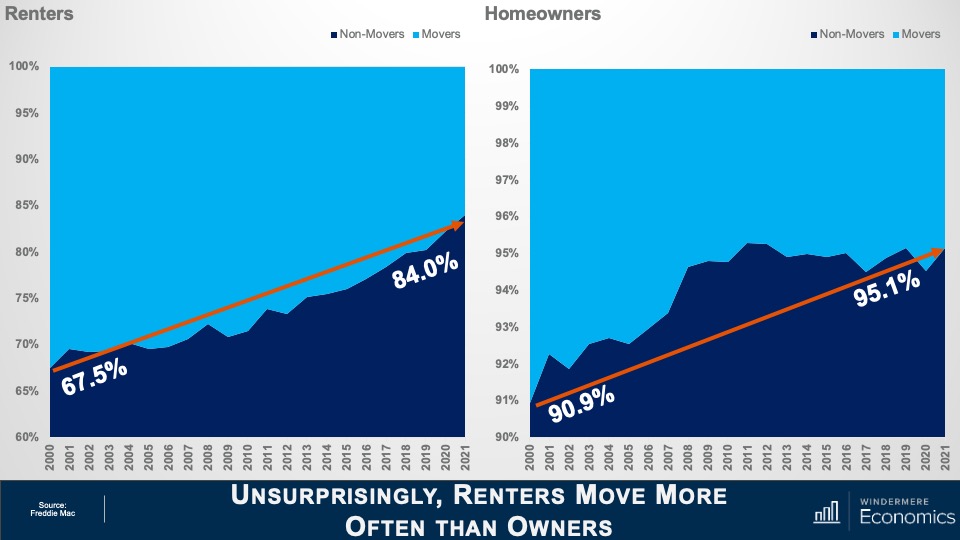

Unsurprisingly, Renters Move More Often than Owners

And when we break this down between homeowners and renters there is quite the discrepancy between the two groups. Although the number of renters not moving has risen from 67½ percent up to 84% since 2000, the number of homeowners staying put has moved from almost 91% all the way up to 95% last year.

So, the data thus far is not suggesting that we saw any form of mass exodus following the pandemic, in fact we haven’t been moving as much for the past 2-decades, but people did move since COVID-19 hit and the reasons they did were fascinating. The following charts are broken up into four categories of movers: those who moved for family reasons; those who moved for employment related reasons; those that moved for housing related reasons; and finally, those that moved for other reasons.

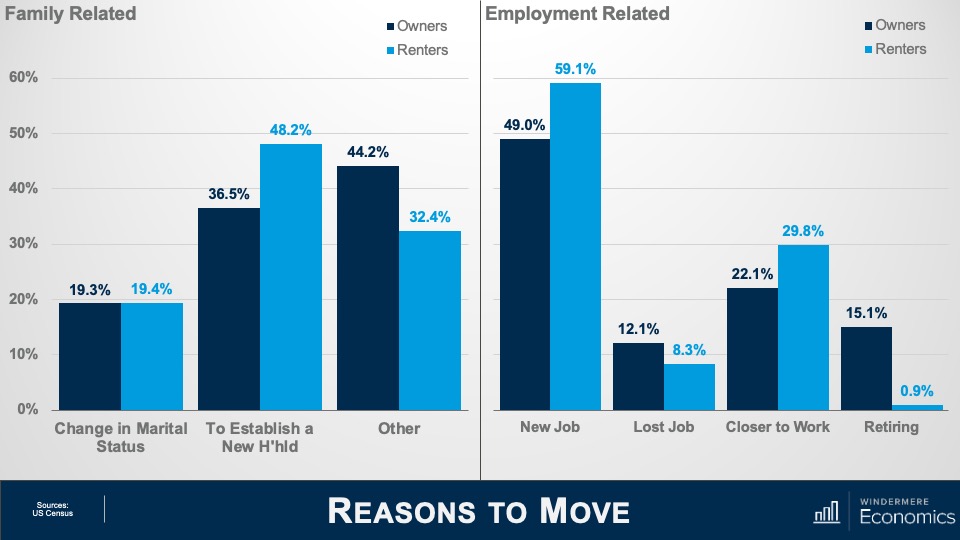

Reasons to Move (1)

So, starting with family-related reasons, it was not surprising to see the major reason for both owners and renters to move was to establish a new household, nor was it surprising to see a greater share of renters headed out on their own than homeowners. Finally, the share of those moving because of a change in marital status was essentially the same between renters and homeowners. And when we look at employment related reasons for people moving last year, a greater share of renters moved because of a new job than homeowners, and more renters moved to be closer to their workplaces than did homeowners. Again, not really surprising, given that a large share of renters work in service-based industries and therefore proximity to their workplaces is important. You will also see that a greater share of homeowners than renters moved because they lost their jobs and, finally—and not at all surprisingly—far more homeowners moved because they chose to retire than renters.

Reasons to Move (2)

And when we look at housing related reasons that people moved, a large share of owners and renters moved from their current home or apartment and into a new, bigger, better house or apartment. A statistically significant share looked to move into a better neighborhood, and I do wonder whether owners were doing this because of the ability to work from home and possibly move to a better location further away from their workplaces. And even though renters tend to stay closer to their workplaces, I wonder whether these renters weren’t in white-collar industries and that the ability to work from home has led them to move into an area that they perceive to be better suited to them.

And finally, a significant share of renters moved because of the fact that rents have been skyrocketing over the past 18-months or so. This clearly impacted some homeowners, too. And finally, under the “other” category, more renters than owners moved because they were either entering or exiting a relationship with a domestic partner, and more renters left to either go to college or because they had completed their degrees.

Health-related reasons for moving had a significant impact on homeowners over renters, and I found it particularly interesting to see a lot of owners saying that “climate” was a reason for their move. Of course, I can only hypothesize as to whether people are simply looking to move to warmer climates or whether climate change is starting to have an increasingly large influence on where we choose to live. My gut tells me that climate change is becoming a far more important consideration for homeowners, although we can’t deny that a lot of people, specifically on the East Coast, moved South during the pandemic.

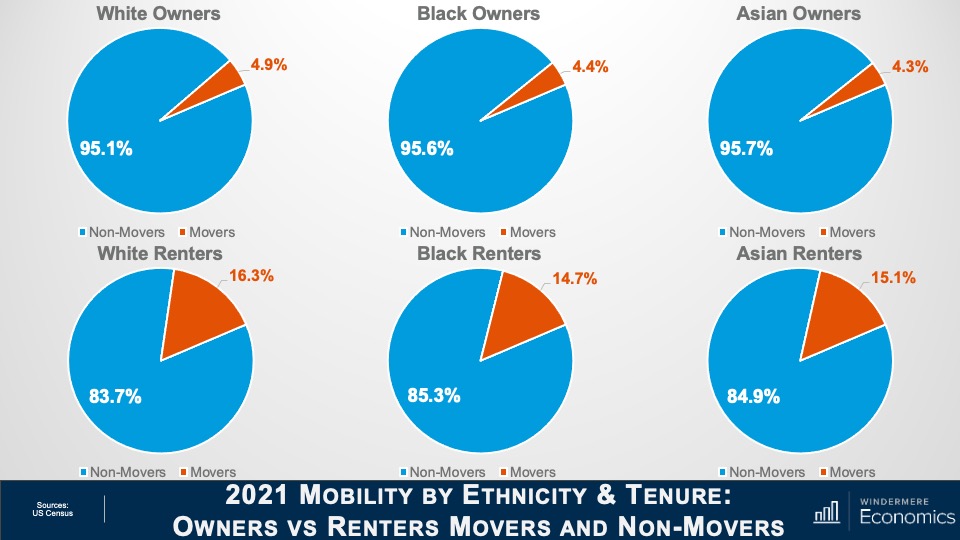

These next few charts break down movers not just by whether they our owners or renters but also by ethnicity.

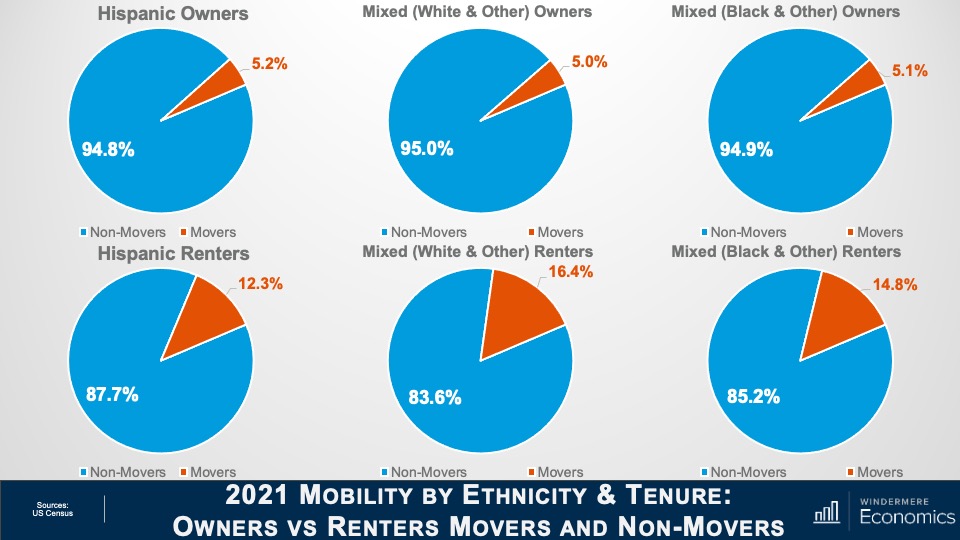

2021 Mobility by Ethnicity & Tenure: Owners vs Renters Movers and Non-Movers

Here you can see that homeowners across these three ethnicities were pretty much uniform in their desire to stay in their existing home with only 4 to 5% moving. And renters who, as we have already seen, did move more frequently last year than homeowners, were also in a very tight range at between 83 and 85%.

2021 Mobility by Ethnicity & Tenure: Owners vs Renters Movers and Non-Movers (2)

And the same can be said about Hispanic owners and mixed race families, with about 95% not moving last year. Now this is modestly lower than White, Black, or Asian households, but the difference is very marginal. As for renters, between 83 and almost 88% of them within these three ethnicities moved last year, but you will see a bigger share of Hispanic renters stayed put as opposed to all the other ethnicities shown here.

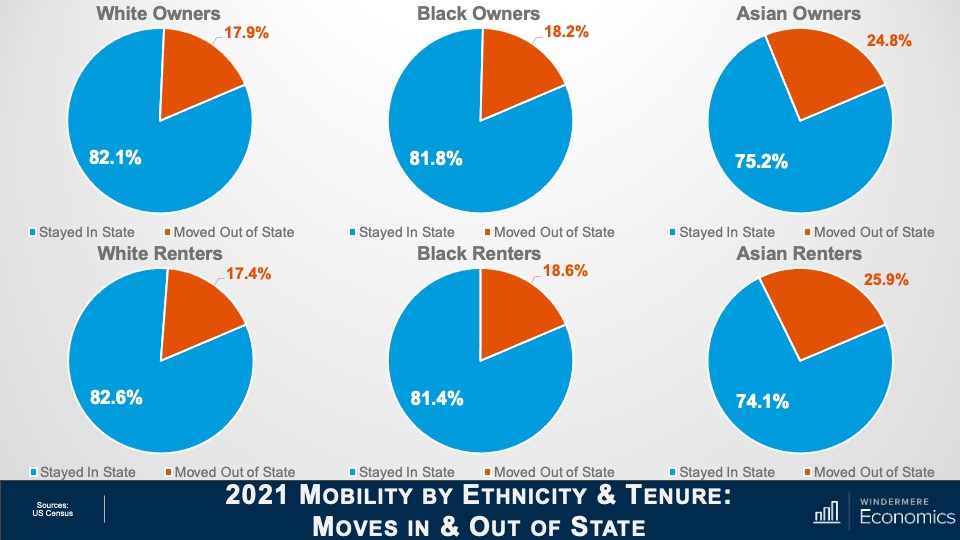

2021 Mobility by Ethnicity & Tenure: Moves In & Out of State

Looking closer now at those who did move, even though fewer Asian households moved when compared to all other ethnicities, far more left the state than stayed, and the same was true for Asian renters with over a quarter moving out of state.

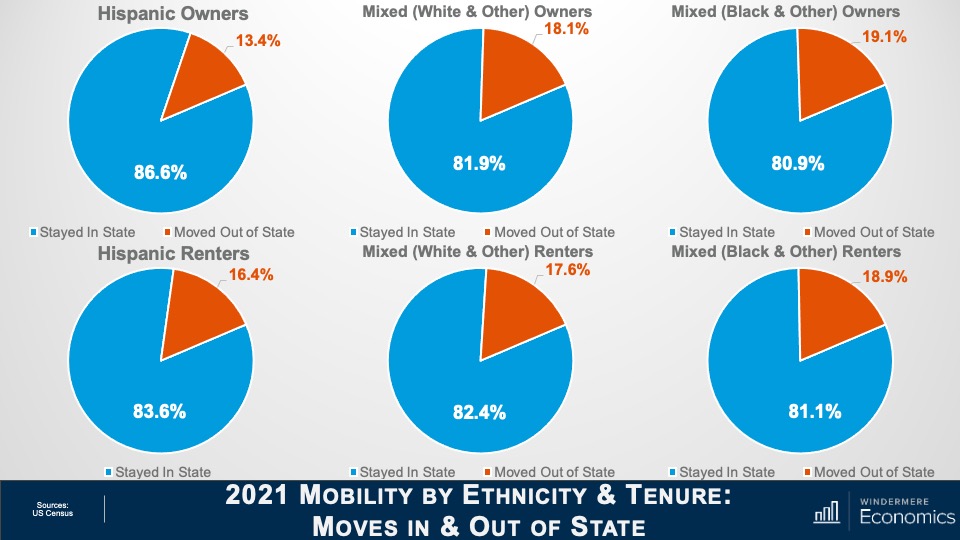

2021 Mobility by Ethnicity & Tenure: Moves In & Out of State (2)

Again, a greater share of the Hispanic homeowners who did move last year stayed in the state where their old house was, and the share of mixed households was roughly at the average for all ethnicities. And the share of Hispanic and mixed-race renters who stayed in State was also about average.

What I see from the data is that the huge shift that many expected during COVID has not been affirmed—at least not by the numbers we have looked at. That said, we are sure to see numerous revisions because of the issues that COVID 19 has posed on Census takers, so we may get a different story as more data is released and revisions posted. What I found to be most interesting in the numbers we have looked at was the massive increase in renters moving in with their “significant others.” But I am not surprised, given that there are around 48½ million people aged between 20 and 30, and this is their time!

And I was also interested in the share of the population who moved due to climate. I will be doing some more digging around in the darkest recesses of the Census Bureau website to see if I can find out more about this. Although I can’t confirm it, my gut tells me that climate—and specifically climate change—will be a factor of growing importance when people are thinking about where they want to live.

What Happens When a Buyer Backs Out of a Real Estate Transaction?

Yes, the dream scenario for selling a home is that the entire process goes off without a hitch. But the reality is that sometimes there will be bumps in the road, and the best thing you can do is work closely with your agent to be prepared for them. One such obstacle is when a buyer decides to terminate their contract to purchase your home after all the terms have been agreed to. So, what’s a seller to do? Here’s a quick overview of how to prepare for this situation and the important role contingencies play when selling your home.

What Happens When a Buyer Backs Out of a Real Estate Transaction?

To be clear, a buyer can back out of a real estate transaction. The outcomes of doing so vary greatly. In certain cases, the buyer walks from the table with all their money intact. In others, they will have some fiduciary responsibility to the seller. If a buyer is hesitant about purchasing a home, the best time to back out of the deal is before their offer is accepted. As things progress, the ramifications of a buyer backing out can get messier. Once the purchase agreement is signed by both parties, it becomes legally binding, and the sale of the property can proceed.

After your agent and the buyer’s agent agree on purchasing terms, the buyer will place their earnest money—a deposit of funds to indicate that the buyer is serious about their offer and intends to pay the seller—in escrow to make sure they distribute properly when the deal goes through. Whether the buyer is on the hook for the funds in escrow depends on the terms of the contract, how far along you are in the selling process, and the corresponding state laws where the home is being sold. If a buyer backs out of the deal for a reason that was not stipulated in the real estate contract, then the funds will typically go to the seller. Still, this scenario can leave sellers scratching their heads. It’s not as if they’ve done anything wrong, and they thought they had found the right buyer, only to have the carpet ripped out from under them at the last minute. So, how can you protect yourself when selling your home?

Image Source: Getty Images – Image Credit: Paperkites

The Importance of Contingencies

This situation highlights the importance of contingencies. Contingencies exist to protect buyers and sellers from the unknowns of a real estate transaction. Buyers will typically include contingencies in their offer to specify the criteria that will allow them to walk away from the deal unscathed and the timeframes for doing so. As a seller, it’s critical that you work closely with your agent to understand the terms of the buyer’s offer. Read about Common Real Estate Contingencies to understand the ins and out of the different contingencies buyers will generally tie to their offer.

What to Do After a Home Buyer Backs Out

Backup Offers

Backup offers are made with the knowledge that an existing offer is already on the table. They stipulate that if the first offer falls through, the second buyer’s offer is accepted. Talk to your agent about the possibility of accepting backup offers when you sell your home. Whether a buyer backs out due to buyer’s remorse, something they discover in the home inspection process, or for any other reason, backup offers can act as a remedy for their indecision by keeping the line moving to the next buyer.

If a backup offer isn’t on the table, the seller is left with the decision of whether to sell again. It’s true that a relisted home may elicit questions from buyers. They will want to know why the home is being relisted and what went wrong with the previous offer. It’s important to coordinate your relisting strategy with your agent and discuss what disclosures are appropriate. It may be discouraging to deal with a buyer backing out but remember that selling a home is all about finding the right fit. A buyer walking away doesn’t mean your home isn’t worthy of a winning offer, it just means that you haven’t found the right buyer yet.

A Quick Guide to Urban Farming

Urban farming can be a fun way to produce your own nutritious and sustainable food supply for your household while learning about self-sufficiency and gardening. Though urban farming likely won’t replace your household’s entire food intake, it is an environmentally friendly complement that can help lower your reliance upon commercial grocery stores over time.

A Quick Guide to Urban Farming

What is urban farming?

Urban farming or urban agriculture comes in many forms. Whether it’s a backyard or rooftop garden, a community agricultural space, or a small balcony plot, urban farming is the practice of cultivating food by those who live in cities or densely populated areas. Typically using raised garden beds to house produce, urban farming promotes sustainability, health, and a connection to nature. Whether you’re looking to grow a few simple fruits and vegetables or seek to cultivate a flourishing garden, here’s how you can get started.

Plot Out Your Garden

Whether you have a spacious backyard waiting to be tilled into gardening heaven or a smaller, unused section of your flower beds, how much space you’re working with will determine the arrangement of your urban farm. Research the crops you intend to plant and how much space they require, then take measurements in your gardening space before buying materials. Your raised gardening beds should be anywhere from six to thirty-six inches deep. Keeping them less than four feet wide will make it easier to reach across when watering, weeding, and planting.

Planting Your Garden

Once you’ve plotted out your garden space, there are a series of decisions to make about your garden; namely which crops you want to grow, how you’ll pot other plants and flowers, whether you’re going to start from seeds or seedlings, and deciding between manual and automatic watering. If you’re starting from seeds, know that the growing process will take longer, whereas seedlings can help to speed things up. Creating an automatic watering system requires an upfront investment, but you’ll save time, and you won’t have worry about under-watering or dehydrating your garden.

Image Source: Getty Images – Image Credit: FatCamera

Raising Chickens and Keeping Bees

Keeping animals on your property presents new opportunities for sustenance, but it also introduces new challenges. Two animals urban farmers often choose to raise are chickens and bees, which take up a lot less space that other livestock. Before starting either venture, check your local zoning laws.

If you intend to raise chickens, you’ll need to build a coop first. The size of your chicken coop will depend on whether your chickens are able to forage outside the coop or not. If you have the space to let the chickens out, allow two to three square feet per bird in the coop. If the chickens must stay in the coop, you’ll want to make sure they have plenty of space, so it’s recommended to allow five to ten square feet per bird.

Image Source: Getty Images – Image Credit: KseniaShestakova

The key features of a chicken coop include roosts, nest boxes, dust baths, lighting, and protection from local predators. Search online or locally for pre-made chicken coops that fit your property’s needs or make it a DIY project. A commercial poultry feed will provide your chickens with the basic nutrients they need, but keep in mind that many foods outside of their normal diet can alter egg flavor and have adverse health effects. So, if you’re thinking about incorporating table scraps into their diet, make sure those foods agree with their systems before doing so.

To keep bees at home, start by reaching out to local beekeeping associations to inquire about purchasing bees and when you can expect your colony to arrive. Once you have a timeline set, you can go about gathering supplies. There are two common hive systems used for keeping bees: a Langstroth hive; which is a system of stacked rectangular boxes with removable frames, and a top-bar hive; which is a series of horizontally connected boxes. Gear up by purchasing protective beekeeping clothing, tools, and feeding supplies. After you introduce your bees to their new hive, continually monitor their behavior and tend to their seasonal needs. Spring is generally the best time of year to start a hive, since it gives bees plenty of time to build up their colony and produce and store honey before winter arrives.

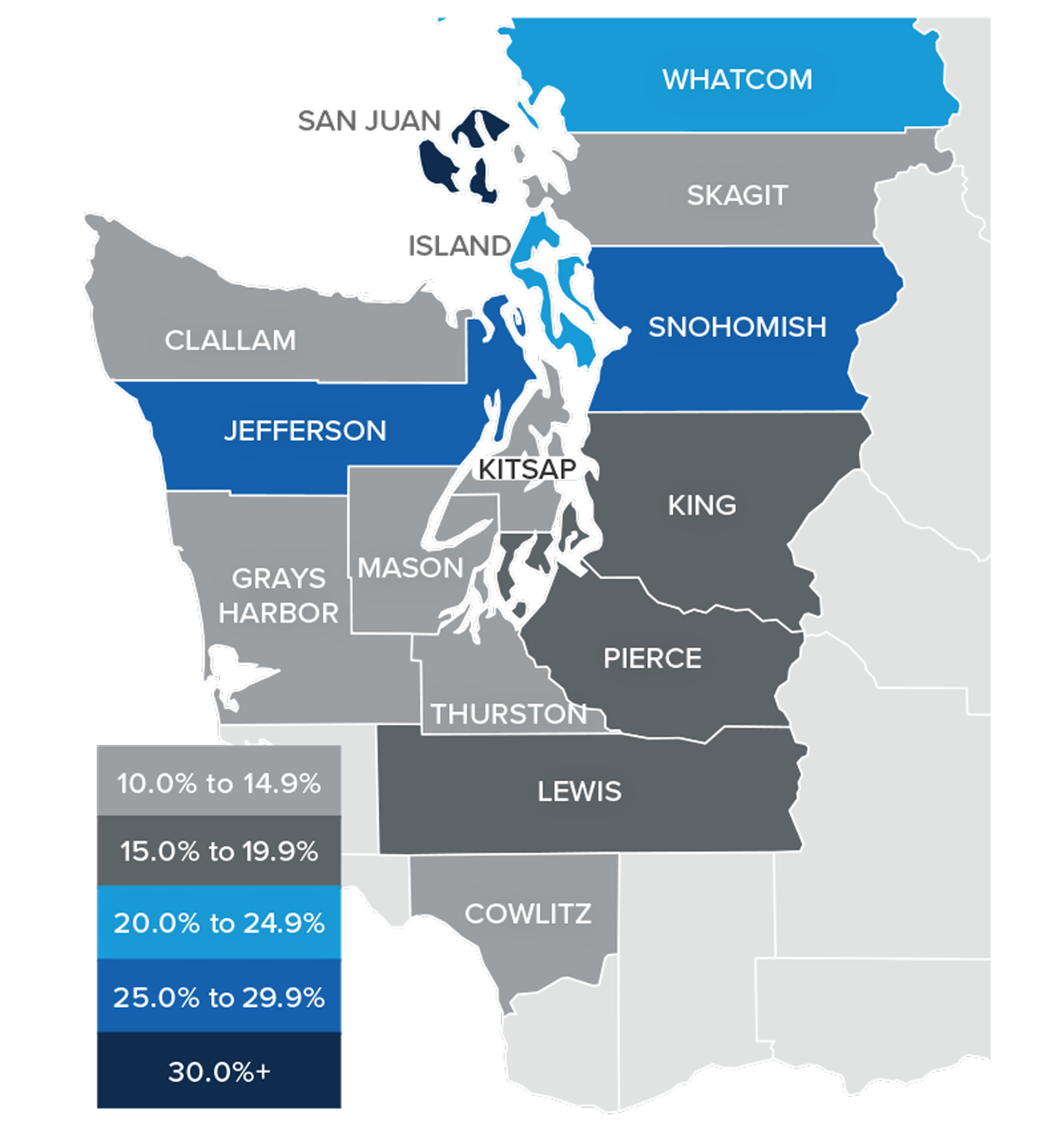

Q1 2022 Western Washington Real Estate Market Update

The following analysis of select counties of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

The post-COVID job recovery continues. Though data showed the number of jobs dropped in January, February saw gains that almost offset the jobs lost the prior month. As of February (March data is not yet available), the region had recovered all but 47,000 of the more than 300,000 jobs lost due to the pandemic. Of note is that employment levels in Grays Harbor, Thurston, San Juan, and Clallam counties are now above their pre-pandemic levels. In February, the regional unemployment rate rose to 4.1% from 3.7% in December. Although this may be disconcerting, an improving economy has led more unemployed persons to start looking for a job, which has pushed the jobless rate higher. I expect the regional economy to continue expanding as we move into the spring and summer, with a full job recovery not far away.

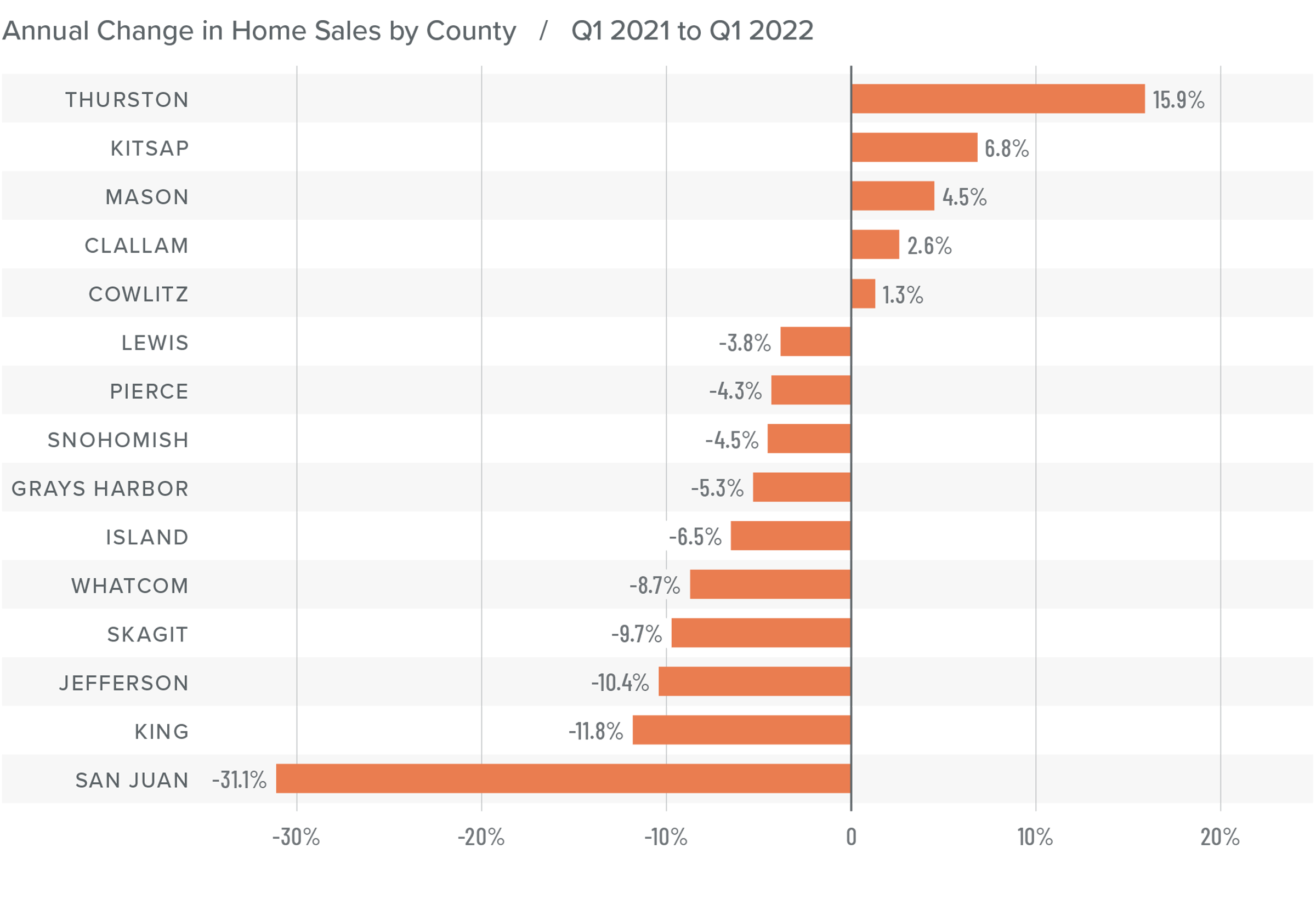

Western Washington Home Sales

❱ In the first quarter of 2022, 15,134 homes sold, representing a drop of 5.8% from the same period a year ago, and down 31.7% from the fourth quarter.

❱ Yet again, supply-side constraints limited sales. Every county except Snohomish showed lower inventory levels than a year ago.

❱ Sales grew in five counties across the region but were lower across the balance of the counties contained in this report. Compared to the fourth quarter, sales were lower across all market areas.

❱ The ratio of pending sales (demand) to active listings (supply) showed pending sales outpacing listings by a factor of 6.7. Clearly, the significant jump in mortgage rates in the first quarter has not yet impacted demand. Rather it appears to have stimulated buyers partly due to FOMO (Fear of Missing Out)!

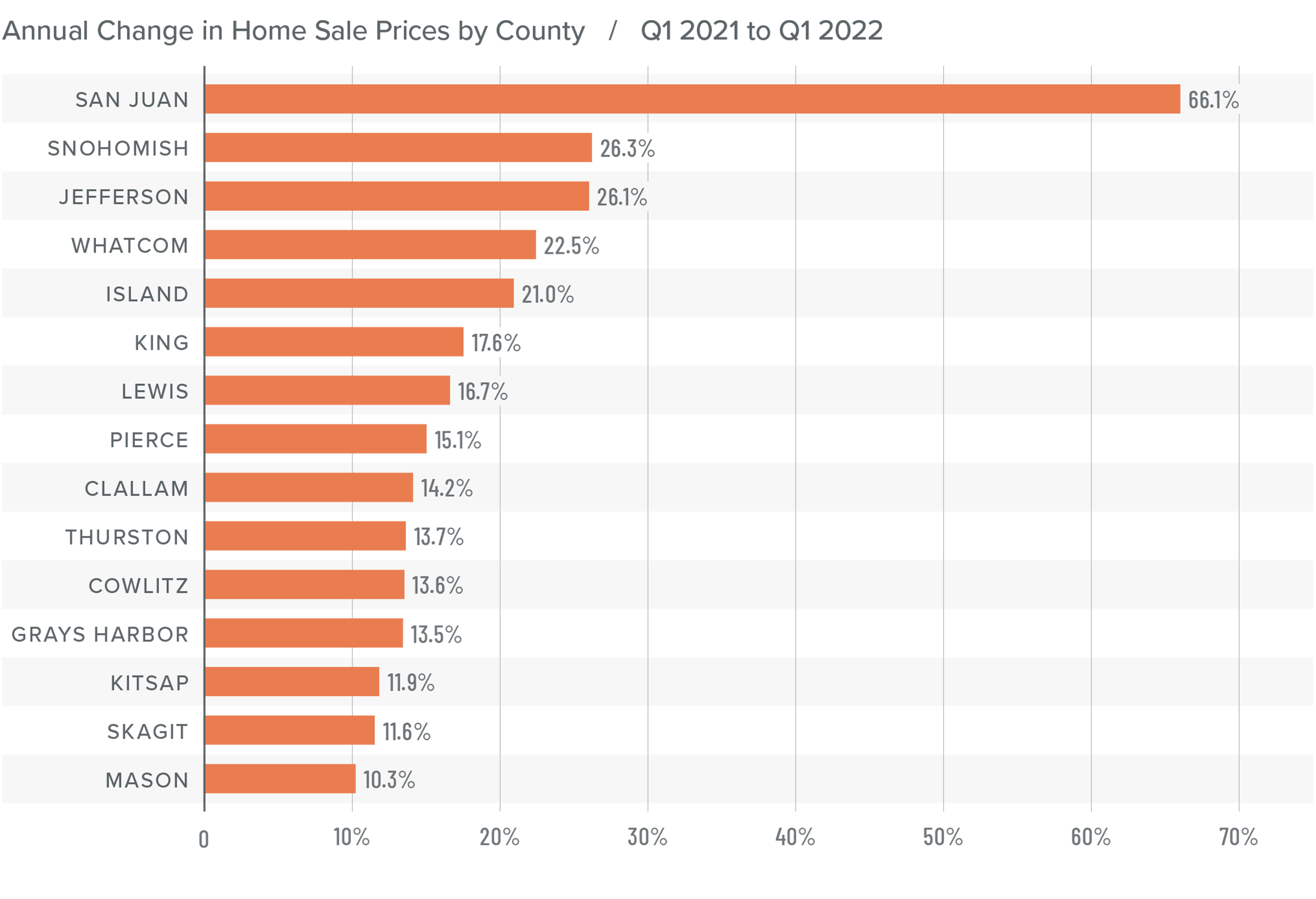

Western Washington Home Prices

❱ Although financing costs have jumped, this has yet to prove to be an obstacle to buyers, as prices rose 16.4% year-over-year to an average of $738,152. Naturally, there is a lag between rates rising and any impact on market prices. It will be interesting to see what, if any, effect this has in the next quarter’s report.

❱ Compared to the same period a year ago, price growth was again strongest in San Juan County, but all markets saw prices rising more than 10% from a year ago.

❱ Relative to the final quarter of 2021, all but Kitsap (-2.7%), Mason (-1.5%), Skagit (-1.8%), Jefferson (-6.3%), and Clallam (-0.1%) counties saw home prices rise.

❱ The market remains supply starved. While increases in “new” listings suggest that more choice is coming to market, it remains insufficient to meet demand.

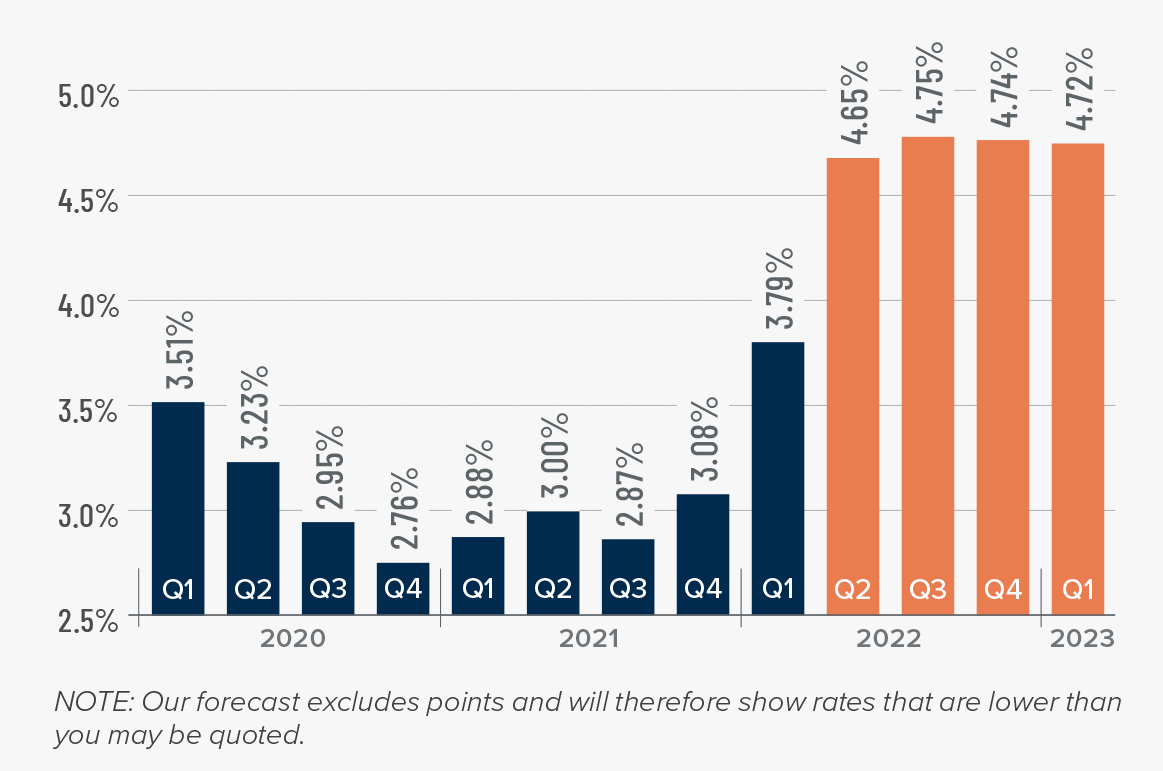

Mortgage Rates

Average rates for a 30-year conforming mortgage were 3.11% at the end of 2021, but since then have jumped over 1.5%—the largest increase since 1987. The surge in rates is because the market is anticipating a seven- to eight-point increase from the Federal Reserve later this year.

Because the mortgage market has priced this into the rates they are offering today, my forecast suggests that we are getting close to a ceiling in rates, and it is my belief that they will rise modestly in the second quarter before stabilizing for the balance of the year.

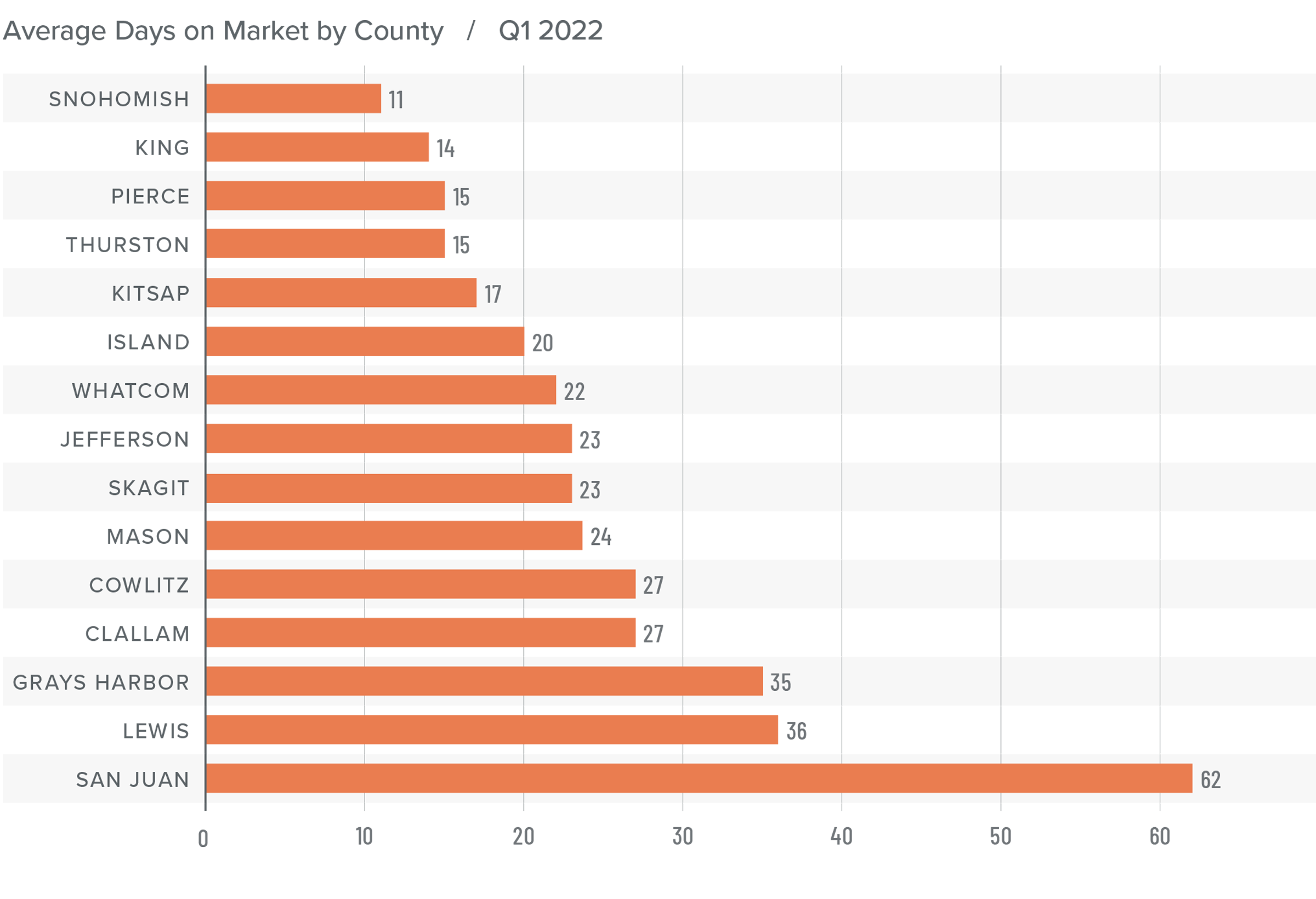

Western Washington Days on Market

❱ It took an average of 25 days for a home to go pending in the first quarter of 2022. This was 4 fewer days than in the same quarter of 2020, but 2 days more than in the fourth quarter of 2021.

❱ Snohomish, King, and Pierce counties were the tightest markets in Western Washington, with homes taking an average of 11 to 15 days to sell. The greatest drop in market time compared to a year ago was in San Juan County, where it took 23 fewer days for homes to sell.

❱ All but five counties saw average time on market drop from the same period a year ago, but the markets where it took longer to sell a home saw the length of time increase only marginally.

❱ Quarter over quarter, market time dropped in Snohomish, King, and Pierce counties. Jefferson and Clallam counties also saw modest improvement. In the balance of the region the length of time a home was on the market rose, but seasonality undoubtedly played a part.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The numbers have yet to indicate that demand is waning amid rising interest rates, but this is sure to become a greater factor as we move into the spring. A leading indicator I pay attention to is changes to list prices and, in most counties, these continue to increase. This suggests that sellers remain confident they will be able to find a buyer even in the face of higher borrowing costs. If this pace of increase starts to soften, it may be an indication of an inflection point, but it does not appear to be that way yet.

Given all the factors discussed above, I have decided to leave the needle in the same position as the last quarter. The market still heavily favors sellers, but if rates rise much further, headwinds will likely increase.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link